Term Life Insurance

In today’s fast-paced world, ensuring financial security for your loved ones is paramount. One of the most effective ways to achieve this is by investing in term life insurance. This article will provide you with an in-depth understanding of what term life insurance is, how it works, its benefits, and why you should consider it as an essential part of your financial planning.

Introduction to Term Life Insurance

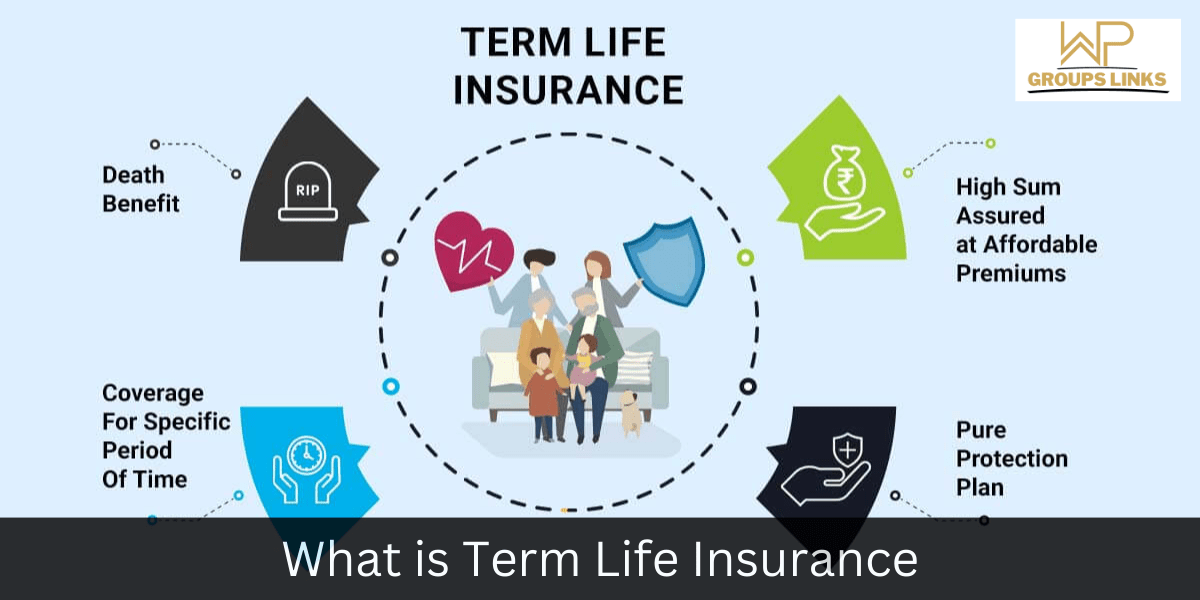

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the “term.” Unlike whole life insurance, which covers you for your entire life, term life insurance offers protection for a predetermined number of years, typically ranging from 10 to 30 years. This insurance is designed to provide a financial safety net for your beneficiaries in case of your untimely demise during the policy’s term.

How Does Term Life Insurance Work?

Term life insurance is relatively straightforward. You pay regular premiums to the insurance company, and in return, they provide a death benefit to your chosen beneficiaries if you pass away during the term of the policy. If you survive the term, the policy expires, and there is no payout. It’s a pure protection plan with no cash value accumulation.

Choosing the Right Coverage

Selecting the appropriate coverage amount is crucial when purchasing term life insurance. Consider your current financial obligations, such as mortgage payments, debts, and your family’s living expenses. The coverage should be enough to ensure that your loved ones can maintain their lifestyle and meet financial obligations if you’re no longer there to provide for them.

Term vs. Whole Life Insurance

Term life insurance differs significantly from whole life insurance. While term insurance provides coverage for a specific period, whole life insurance lasts your entire lifetime and often includes a cash value component that can be borrowed against or withdrawn. Term life insurance is typically more affordable, making it an attractive choice for those seeking pure protection without the added investment component.

Key Features of Term Life Insurance

- Affordability: Term life insurance offers substantial coverage at a lower premium cost compared to whole life insurance.

- Fixed Premiums: Premiums remain constant throughout the policy term, making it easier to budget.

- Convertible Options: Some term policies can be converted into whole life or permanent insurance at a later date.

- Renewable: You may have the option to renew your term policy at the end of the term, although premiums may increase.

- Death Benefit: Tax-free death benefit paid to beneficiaries upon the policyholder’s passing.

Benefits of Term Life Insurance

Financial Security

Term life insurance provides a financial safety net for your loved ones, ensuring they can maintain their lifestyle, pay off debts, and cover expenses in your absence.

Affordability

Compared to whole life insurance, term life insurance is more budget-friendly, making it accessible for many individuals and families.

Flexibility

Term policies are flexible, allowing you to choose the term length that aligns with your specific needs and financial goals.

Who Needs Term Life Insurance?

Term life insurance is an essential consideration for:

- Parents: To provide for the financial well-being of their children.

- Breadwinners: To replace lost income for their families.

- Homeowners: To cover mortgage payments.

- Debtors: To ensure debts are not passed on to family members.

Term Life Insurance Cost Factors

Several factors influence the cost of term life insurance, including:

- Age: Younger individuals typically pay lower premiums.

- Health: Your overall health and medical history play a significant role.

- Coverage Amount: Higher coverage amounts lead to higher premiums.

- Term Length: Longer terms may have higher premiums.

Applying for Term Life Insurance

The application process involves completing a health questionnaire and, in some cases, undergoing a medical examination. The insurance company assesses your risk based on this information to determine your premium rate.

Common Exclusions in Term Life Insurance

Most term life insurance policies have exclusions, such as suicide within the first two years of the policy and death resulting from illegal activities or war.

Renewable and Convertible Term Policies

Some term policies offer the option to renew or convert to a permanent policy at the end of the term. This can be beneficial if your circumstances change.

Term Life Insurance Riders

Riders are additional benefits that you can add to your term life insurance policy for an extra cost. Common riders include critical illness, accidental death, and disability riders.

When to Review Your Term Life Insurance Policy

It’s essential to review your term life insurance policy periodically, especially when major life events occur, such as marriage, the birth of a child, or a change in financial status.

Term Life Insurance Claim Process

When the unfortunate event of a policyholder’s passing occurs, the term life insurance claim process is initiated. This process is designed to ensure that the beneficiaries receive the death benefit, providing them with the financial support they need during a challenging time. Below are the key steps involved in the term life insurance claim process:

Step 1: Notify the Insurance Company

The first step is to inform the insurance company of the policyholder’s death as soon as possible. You can usually find the contact information on the policy documents or the insurance company’s website. It’s crucial to provide accurate information and details about the policy, including the policy number and the insured person’s name.

Step 2: Obtain the Necessary Forms

Upon notification, the insurance company will provide you with the required claim forms. These forms typically include a death claim form and may request documents such as a death certificate and any other supporting documents as specified by the insurer.

Step 3: Complete the Claim Forms

Carefully fill out the claim forms provided by the insurance company. Make sure to include all the requested information accurately. This may include details about the policyholder, the cause of death, and the beneficiaries’ information. Be thorough in your responses to expedite the processing of the claim.

Step 4: Gather Supporting Documents

In addition to the claim forms, you will likely need to submit certain documents to support the claim. The most crucial document is the death certificate, which serves as proof of the policyholder’s passing. Other documents may include medical records, autopsy reports, and any other documentation required by the insurer.

Step 5: Submit the Claim

After completing the necessary paperwork and gathering the required documents, submit the claim to the insurance company. It’s advisable to send these documents via certified mail or through a secure online portal, if available. This ensures that your claim is received and acknowledged by the insurer.

Step 6: Review and Verification

Once the insurance company receives the claim, they will review the submitted documents and verify the information provided. This process may take some time, but it is essential to ensure the validity of the claim.

Step 7: Evaluation and Payout

After verifying the claim, the insurance company will evaluate it and determine whether the policy’s conditions have been met. If everything is in order, they will approve the claim and proceed with the payout. The death benefit will be disbursed to the designated beneficiaries as specified in the policy.

Step 8: Receiving the Payout

Once the claim is approved, beneficiaries will receive the payout in a lump sum. It’s essential to have a plan in place for managing the funds, as this money is intended to provide financial security and support during a difficult time.

It’s crucial to keep lines of communication open with the insurance company throughout the claim process. If you encounter any challenges or have questions, don’t hesitate to reach out to the insurer’s customer service for assistance.